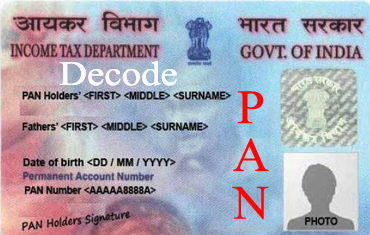

Decode the PAN

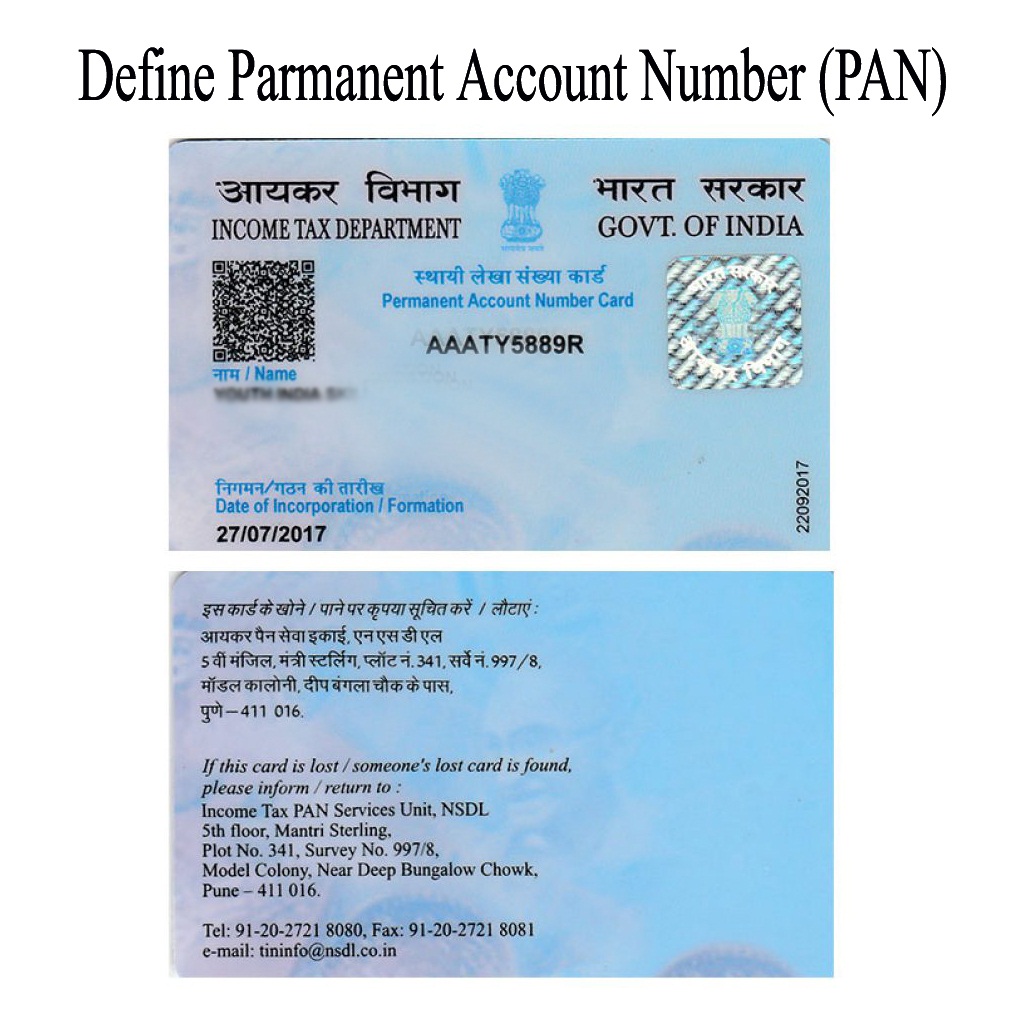

In this article, We try to understand about PAN. PAN stands for Permanent Account Number. Permanent Account Number is a ten-digit(10) alphanumeric number, issued by Income Tax Department of India that is valid across India.

PAN is a unique number for all individuals or organizations. It is not affected by a change of name, address within or across state in India. It is not acceptable as proof of Indian citizenship but necessary for filling income tax returns.

PAN is compulsory option for Opening New Bank Account/New Landline Telephone Connection/New SIM Activation/ Purchasing of Foreign Currency/ Bank Deposits above 50000/Purchase and sale of immovable properties/Vehicles etc.

A Typical Permanent Number is look like FMVPS1023K. The logic behind the array of numbers and alphabets is as follows:-

1. First three characters like “FMV” in the above PAN are the alphabetic series running from AAA to ZZZ.

2. The fouth character like”P” in the above PAN represents the status of the PAN holder.

Status Categories:-

For Individual – “P”

For Firm – “F”

For Company – “C”

For Government – “G”

For Local Authority – “L”

For Trust – “T”

For Association Of Person (AOP) – “A”

For Body of Individuals (BOI) – “B”

For Hindu Undivided Family (HUF) – “H”

For Artificial Juridical Person (AJP) – “J”

3. The fifth character like “S” in the above PAN represents

(a) first character of the PAN holder ‘s (Individual’s) last name or surname i.e. It brings “S” from Sinha.

(b) first character of the PAN holder ‘s (Organisation’s Categories) like “T” for Trust/”F” for Firm.

4. Next four (6th to 9th) characters like 1023 are numeric that represents sequential number running from 0001 to 9999.

5. The last character of the PAN like “K” in the above PAN is an alphabetic check digit to verify the validity of the current code.

यदि आर्टिकल पसंद आया और ज्ञानवर्धक लगा तो ज्यादा से ज्यादा शेयर करें तथा अगले पोस्ट की जानकारी के लिए हमें facebook और whatsapp पर फॉलो करें एवं सुझाव दे कि आपको अगला आर्टिकल किस विषय पर चाहिए।…धन्यवाद…